Financial technology company SMCE has rolled out an artificial intelligence (AI)-driven platform, dubbed Chaintrade.ai, aimed at transforming data intelligence for the capital markets.

Formed as a joint venture between RedMatter Capital and Plato AI, Chaintrade was acquired by SMCE with a commitment to launch the application within 60 days of the acquisition.

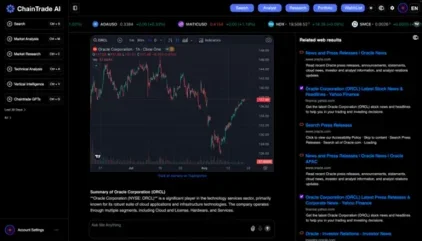

The new platform offers a portfolio of AI-driven applications designed to improve the way investors, analysts, and financial institutions access and analyse market data.

It is expected to enable smarter decision-making as well as foster innovation across the industry.

By leveraging AI, Chaintrade.ai provides deep insights into the capital markets.

The platform incorporates advanced machine learning algorithms and data analytics tools to deliver real-time, actionable intelligence across various asset classes, including equities, commodities, exchange-traded funds (ETFs), bonds, and indices.

Chaintrade.ai will also utilise AI to allow users to stay ahead of market trends, optimise their trading strategies, and make informed decisions with a high degree of accuracy.

SMCE CEO Erik Blum said: “This commercial release represents a significant milestone in the company’s execution strategy and invite the entire Investment and Trader community to test ride the application.

“Based on the modularity of the application’s framework, we will be announcing the launch of several other plug in applications to drive greater user value and adoption.”

The platform has a range of vertically focused AI applications, each tailored to meet the specific needs of different market segments.

It will deliver specialised tools that enhance understanding and support strategic success if users are analysing global equities, examining commodity markets, or exploring the dynamics of ETFs.

Chaintrade.ai is built on a foundation of continuous learning, with AI models that are regularly refined and updated to adapt to the evolving dynamics of global markets.

Key features of Chaintrade.ai include access to real-time market data, proprietary AI models that deliver predictive insights and trend analysis, user-friendly dashboards for personalised research experiences, and comprehensive analysis across a wide range of asset classes.

The platform is said to adhere to the highest standards of data security and regulatory compliance.

Additionally, Chaintrade.ai is designed to scale, with plans to continuously expand its capabilities and integrate emerging technologies such as blockchain and decentralised finance (DeFi).