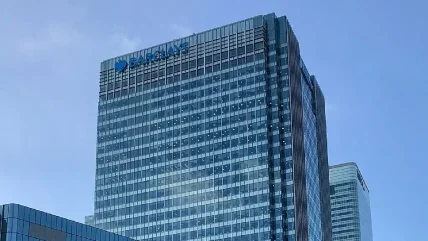

The Financial Conduct Authority (FCA), the UK’s financial regulator, has fined British retail bank Barclays £40m over its failure to disclose certain arrangements with Qatari entities in 2008.

The regulator fined Barclays after the lender decided to withdraw its referral of the FCA’s planned action to the Upper Tribunal, based on its findings.

According to FCA, Barclays was reckless and lacked integrity in raising funds from overseas investors, including Qatar, during its 2008 capital raising.

In 2013, the financial watchdog initially issued warning notices to the British lender, and the case was paused pending criminal proceedings brought by the Serious Fraud Office.

FCA restarted the case after the dismissal of proceedings against Barclays and the acquittal of the other parties.

In October 2022, the regulator announced its decision to fine Barclays £50m in total, and Barclays chose to refer the case to the Upper Tribunal, which hears enforcement cases.

According to FCA, banks sought emergency recapitalisation in 2008, due to a global economic downturn.

The regulator said it welcomes Barclays’ decision to move its case to the Upper Tribunal.

FCA joint executive director of enforcement and market oversight Steve Smart said: “Barclays’ misconduct was serious and meant investors did not have all the information they should have had.

“However, the events took place over 16 years ago and we recognise that Barclays is a very different organisation today, having implemented change across the business. It is important that listed firms provide investors with the information they need.”